Opinion & Analysis

Crises as Catalysts – How Data Solutions Helped Businesses Make it Past a Global Lockdown

Written by: Andrii Vasyliev | Chief Data and Analytics Officer, E100

Updated 1:09 PM UTC, April 29, 2024

In the ever-evolving global business environment, crises showcase a remarkable capacity to propel companies toward heightened adaptability and innovation. In this thorough exploration, we navigate the intricate landscape of data transformation and governance, shedding light on the pivotal role of market crises as powerful catalysts for organizational metamorphosis.

This second article of a three-part series, is a retrospective glance at the years 2020–2021, marked by a series of fuel market crises and innovative data-driven solutions.

In the upcoming sections of the article, we present a meticulously structured analysis of the crisis scenarios we address and the data-driven solutions deployed. Each crisis is depicted as a unique canvas upon which we paint the intricate relationships between the crisis narrative, the business challenges encountered, and the solutions utilized to navigate through the tempest.

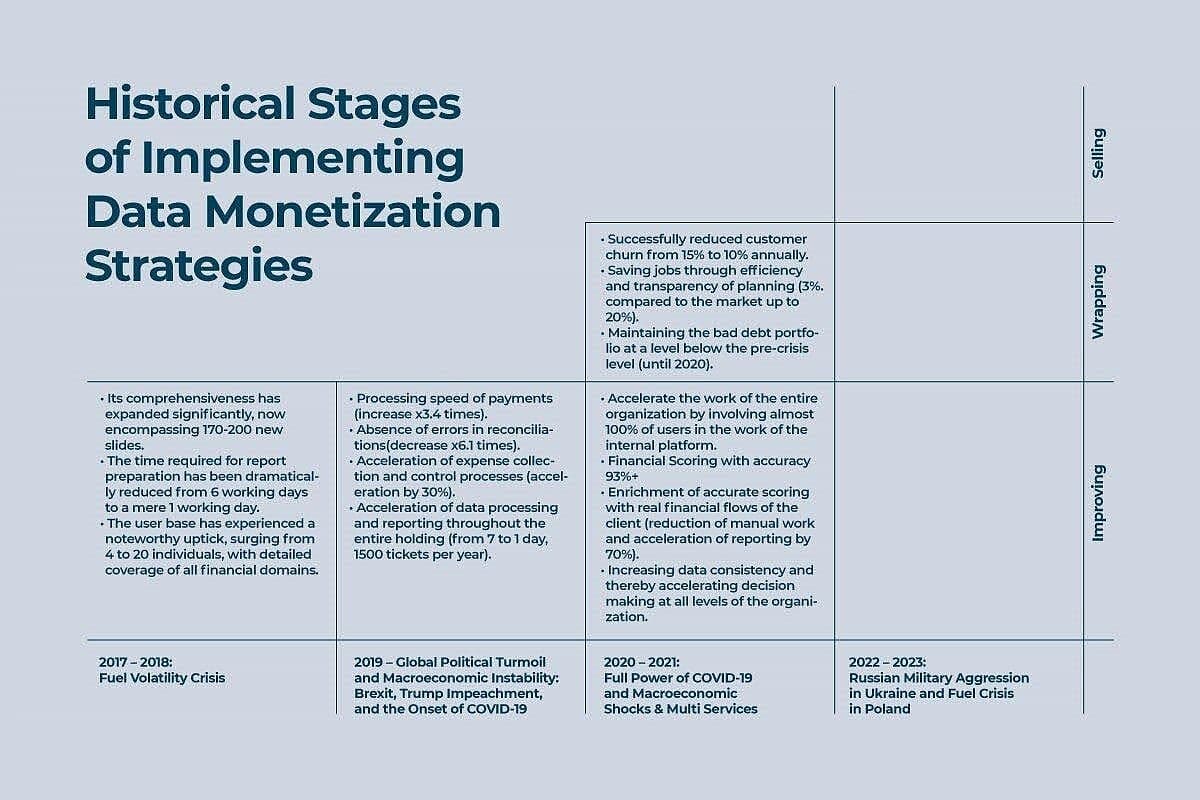

The article undertakes an examination of the benefits of data products based on the MIT CISR Data Monetization Framework (I-W-S Framework), which encompasses three distinct approaches:

-

Improving delivers financial value indirectly by improving processes and work tasks with data, thus reducing the cost of goods or reducing overhead costs.

-

Wrapping delivers financial value indirectly by bundling core products with analytics features and experiences thus increasing the product value proposition.

-

Selling involves the direct conversion of data or information solutions into revenue (Wixom and Rose, 2015).

Each crisis unveils a new facet of the transformative potential of data, and this journey will culminate in a comprehensive understanding of how these challenges have shaped and evolved businesses

Crisis scenarios, business challenges, and data solutions

2020-2021: Full Power of COVID-19 and Macroeconomic Shocks

Crisis scenarios

In the turbulent year of 2020, the paramount crisis was the COVID-19 pandemic, which not only unleashed a global health emergency but also triggered economic upheaval with a significant impact on fuel markets. Simultaneously, the global lockdown disrupted transport and further exacerbated the challenges faced in the fuel industry.

This year also highlighted a surge in defaults of clients, causing concern for churn rates and client retention in the fuel markets.

In this complex landscape, businesses had to display unwavering resilience and engage in collective action to address these multifaceted issues, while also ensuring the continuity of their operations in the turbulent fuel markets.

Business challenges

-

The flexible Scrum methodology proved invaluable amid unprecedented uncertainty, facilitating swift adaptation to evolving client behavior and payment patterns.

-

Our transition to real-time data tracking was game-changing, providing the agility needed to make informed decisions and tackle emerging challenges proactively.

-

Effective collaboration across departments was crucial, ensuring seamless integration of insights and data-driven solutions into our overarching business strategy to navigate complex market conditions.

-

Addressing significant financial challenges, including revenue losses and waning consumer confidence, required tough decisions such as delaying investments and meticulous budget management.

Adhering to government restrictions and support programs demanded adaptability and innovation to maintain financial stability while supporting our workforce and communities.

Data solutions

-

During the lockdown, our data product usage surged as traditional communication channels diminished. Penetration rose from 45% in January to an impressive 97% by July.

-

Real-time data-guided management decisions, offering invaluable insights into customer behavior across multiple dimensions.

-

Enhanced analytics, including hourly and daily reporting tools, improved decision-making quality before the entire board of directors.

-

The management’s adept leadership limited cost-cutting attrition to just 3-5%, in contrast to the market’s 20% average.

-

Hiring resumed in the second half of 2020, signaling a commitment to stability and growth.

-

Financial performance reached an all-time high, showcasing resilience and strength in challenging times.

-

A transformative journey in fintech fortified scoring models with real-time data, minimizing accounts receivable generation.

-

Agile response to customer payment fluctuations demonstrated adaptability and responsiveness.

-

The robust scoring system, with over 94% accuracy, underwent significant enhancement, integrating real-time customer payment data and various API sources.

-

Confidence in management was bolstered, allowing maintenance or increase in financial instrument volume to clients, resulting in unprecedented growth.

-

Implementation of a data-driven approach within sales departments, led by the CCO, drove enhanced efficiency and effectiveness.

Benefits of data-driven solutions

If we use the I-W-S framework as described above, we can see the following picture. Let’s take a point now, and all the data-based products I described in the section above – we have the following distribution.

In the third article, I will articulate the comprehensive impact on the EBITDA indicator, presenting the conclusive figures that underscore the discernible influence on our business, as per our perspective.

About the Author:

Andrii Vasyliev is Chief Data and Analytics Officer at E100. With over 12 years of experience, his achievements include building data platforms from scratch, implementing principles of data governance and management, and creating data-driven products that add significant value to organizations.